Monday, November 27, 2017 was the happiest day of my life.

Why?

I sold my 2015 Honda Crosstour and only had to pay out $15,000 in negative equity to do it.

Yes, you read that right.

I PAID $15,000 to SELL my car.

Now, this may sound silly to be so happy to pay to get rid of a car.

However, this car was the biggest thorn in my side for 2 years.

I’ll talk about my story shortly, but first, let me describe what negative equity is.

What is Negative Equity?

Negative equity is when you have an asset that is worth less than the loan value on that asset.

In more words:

It’s when you buy something and it has less value than what you paid for it.

This can happen in multiple ways.

The most common scenario is when you buy a new car and it loses value the second you drive it off the floor.

Quick Tip: Most negative equity comes from cars, so when you’re thinking about paying more for your next car just remember it’s not a good investment.

Another way this can happen is if you co-sign for someone that already has negative equity.

This is what happened to me.

Before we dive into my story:

If you have negative equity why not join the Chain of Wealth Money Clan so we can tackle your debt together:

My Negative Equity Story

When I was twenty-six years old, I thought I knew everything.

I had an apartment and a stable career.

I was living as well as everyone else I knew.

What I didn’t realize at the time was that I was about to make a HUGE mistake.

I made the fatal decision to co-sign a car loan for a “friend” in order to help them get a lower interest rate.

“If your name is on the loan the interest rate will go down SO much. Please help me, I promise I will make all the payments.”

Foolishly, I did it.

So began a long debt payoff journey.

Lessons are learned the hard way

Being still relatively fresh out of college, I was also super naïve.

I thought I could trust anyone, but as I found out, people can and will do almost anything if there’s enough of a financial incentive.

My friend lied to me- I was under the presumption that I was helping them out, as they were trying to get a lower interest rate.

What I inadvertently did was agree that I was jointly liable for their negative equity.

Anyway, I now “owned” a brand new Hyundai Elantra but I was driving a 2002 Toyota Corolla.

Makes sense, right?

No it doesn’t.

What to do if you've co-signed for negative equity

As you can imagine, this relationship fell apart shortly after this transaction had happened.

Leaving me with the new car and $20,000 of negative equity.

That’s right… $20,000.

After a messy argument of “It’s not my car, it was a gift from you, so you need to pay it” and several trips to visit a lawyer-

I had the car in my possession along with ALL THE DEBT.

So, not really knowing what to do, but knowing I could not pay for this car and risk the possibility of this “friend” coming and taking it from me in the middle of the night.

I had to get rid of it, mainly to get their name off the lease.

The problem with being upside down on your loan

To get rid of an asset with negative equity, you can sell it…

…BUT the problem is that the negative equity doesn’t just go away.

You need to pay back any negative equity you have in the loan.

So instead of being able to get rid of this cosigned car, I had to sell my Corolla and trade in the car with negative equity.

My new car after this disaster was a brand new Honda Crosstour, right off the showroom floor with 33 miles on it.

When I spoke to the finance officer, he said the banks would not loan me the money to buy a cheaper car because I had too much negative equity.

"The bank won't lend you a lot of money unless they feel that they have sufficient collateral."

In my case, I had to take out a really big loan (to cover the negative equity), so they forced me to buy an expensive car.

This was one of those moments that just make no sense.

A $30,000 car tacked with the $20,000 of negative equity left me in a $50,000 hole.

I wanted to die.

Coming To Terms With The Debt

“I’m a teacher, how am I ever going to afford a 7-year loan of $663 a month?” I asked my mom.

It seemed as though my entire life was over.

In her trying to be calm and reassuring tone she told me, “You’re smart, you’ll figure this out and karma is a real thing- they’ll get theirs.”

She was right.

Twenty-seven months later, I was able to get rid of the car.

Let me tell you how I did it- It has been a bit of a strange journey.

Update: I’ve received a ton of feedback on this post and lots of people that have negative equity have bad credit.

Joseph over at Peer Loans Online has created a super helpful list for people with bad credit to get personal loans.

This can really help you out if you’re in a pickle.

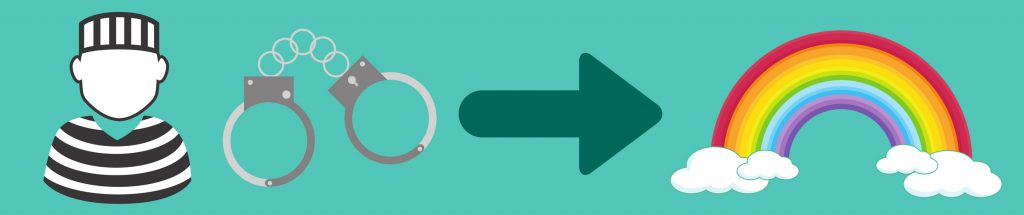

The [surprising] road to recovery

After buying the car, I had to make some serious lifestyle changes.

I moved back in with my mom, teaching full time and side hustling to try make ends meet.

After school and on the weekends, I had a lot of extra time with not much to do, so I got a second job.

I was able to save basically all of my money and make extra payments to the car.

Then, in May of 2016 I bought my first house- a townhouse for my 28th birthday.

I was in love- It felt like things were finally starting to turn around for me.

This house was everything I had wanted and the best part, it was 100% mine and nobody else’s.

It was a really empowering feeling- something I needed at the time.

Time to move on- life is changing

Since I became an expert side hustler to make extra car payments, I decided to rent out the spare bedroom to another young girl needing a temporary place to live- I found her on Craigslist.

Admittedly, it sounds pretty sketchy but we laughed about it later.

This allowed me to save money and make extra payments toward my car loan.

The changes didn’t stop there.

In December 2016, Denis (my boyfriend at the time) moved to Virginia for his job and asked me to consider going with him.

I obviously couldn’t leave my class mid school year, so I was staying in Florida until the school year ended in June- this gave me plenty of time to weigh my options.

Ultimately, home ownership was short lived for me.

I decided to give Virginia a try.

I packed up my classroom that I had been in for the past four years, gave my roommate some notice and put my house up for sale.

My saving grace was that my house had gone up in price so much in one year, that after all closing costs and such, I would have just enough money to get rid of the car.

My house closed on October 4, 2017 and I went right home and tried to privately sell my car.

This came with no such luck. SUV type cars don’t seem to have a high demand on the small city streets in this area.

On the Monday after Thanksgiving, my patience had run up.

I was getting rid of the car before Christmas.

I decided to take my car to a Honda dealership in Bethesda, Maryland.

After some negotiating, they agreed to buy the car for $18,000.

“Come back on Monday so the car can be inspected and then the transaction will be made.”

This was GREAT news!

I’d been waiting for months to hear this.

The final ride

I woke up early that Monday morning and drove 30 minutes to Bethesda, Maryland to the Honda dealership.

At the time of sale, I still owed roughly $32,000.

Honda agreed to pay $18,000 to take the car.

That left me with still owing a lot of money- $15,000.

Walking (in the cold) back from the bank, clutching the check in my hand for an amount that could fund a lavish European family vacation, a swirl of mixed emotions pulsed through my head.

So excited to get rid of this burden that I’ve had for so long but at the same time, almost sure that something would go wrong and I will end up having to take the car back- I was an internal wreck but tried to keep my composure.

As I handed over the check and the keys, I waited for someone to rush in and say a mistake had been made and they weren’t going to take the car.

This, thankfully never happened.

I signed some paperwork, got my Florida license plate and stepped off the property $32,000 lighter.

It was such a surreal feeling; it didn’t even hit me until half way home.

That section of my life was over.

Finally.

Some key takeaways

As you can imagine, I learned a lot from this experience.

Negative equity is not a small thing, however as the old saying goes: “what doesn’t kill you, makes you stronger.”

Here’s some advice so you can avoid a similar fiasco:

• Never co-sign for a friend

• Make your money work for you- I learned this by accident with my house, but it was the best accident-lesson ever

• No matter what mistake you may have made, there is a way out- where there is a will, there is a way.

I think that the hardest part about being in a financial bind is how long it can take to sort itself out.

If you are in a similar situation, the best thing you can do is to refinance your car.

I wish I would have done this.

If you keep at it, you will work it out.

As for that “friend” I don’t know whatever happened to them- we obviously lost touch but my mom was right.

Karma always comes around.

I tried to help, karma came back and helped me.

Now, on to paying off all my student loans! One step closer to becoming debt free!

What's Your Story?

I’d love to hear your negative equity experience.

Or, if you would like to vent- leave a comment below.

Trust me, you are not alone.

Oh gosh this sounds like a terrible state of affairs – even more of a shame that your relationship with your friend has deteriorated. Good move on trying to sort it. Seems like you’ve done the right thing by biting the bullet and taking the hit.

Thanks for the post, I’m in a similar situation now. I’m hoping to refinance my 2015 Toyota Camry soon. Purchased it with 22.48% interest! Hate the fact that most of my monthly payments are going to the interest. Your post helps me see the light at the end of the debt tunnel.

Yikes, that’s a huge interest rate! I saw you recently got Good credit- kudos to you! 🙂

Negative equity can eat your finances up, which is why I only put my money on second-hand cars, especially because it’s a dead investment. I don’t want my huge money going on anything that depreciates…

That’s a good way to handle cars, I really don’t know why people buy new cars when they depreciate so fast..

Kind of in the same situation, but rather than getting someone to take on the negative equity which has been extremely difficult my husband can’t work till he gets a truck that can handle what is required of his job. We are kind of in a damned if do and damned if don’t situation. I don’t know what else to do.

That’s a really tough position to be in, can he rent a truck until he has the money to purchase one himself?